The cost of a living trust will often be three to five times more than the cost of preparing a will. In the short term, a will would seem to be more economical. But think again: When your estate goes through probate, as most often happens when you have chosen a will, the costs of the probate administration will usually run between 5% to 10% of the gross value of your estate. Even with a modest $200,000 estate, the probate related cost could run your estate $10,000 to $20,000, or more.

- Trusts

- Wills

- Advance Directives

- Paying for Long-Term Care

- Guardianship

- Power of Attorney

- Legal Implications of Dementia and Alzheimer’s Disease

- Texas Elder Rights, Marital Issues, and the Homestead

Settlor, Grantor, Trust-Maker, and Trustor

The terms grantor, settlor, trust-maker, and trustor all mean the same thing for estate planning purposes. All refer to the person who creates a trust. That individual can be different from other titles seen sprinkled throughout the trust agreement, which is where things can get a bit confusing.

The trustee is the individual charged with managing the trust. Often, the trust-maker of a revocable living trust will appoint themselves as the trustee (the handler of the trust) of their own trust. In that case, all of the terms—”settlor,” “trustor,” “grantor,” and “trustee”—refer to the same person.

That isn’t the case with irrevocable trusts, which typically require that the trustor hand over control of the trust to another party appointed to act as the trustee. 1

In nearly all revocable living trusts, the Grantor of the trust is also the primary beneficiary of the trust. Children or other named successor beneficiaries only benefit from trust assets after the death of the Grantor.

Definition of a “Grantor, Settlor, or Trustor” of a Trust, Foundation paper one – What is a Trust?

Introduction

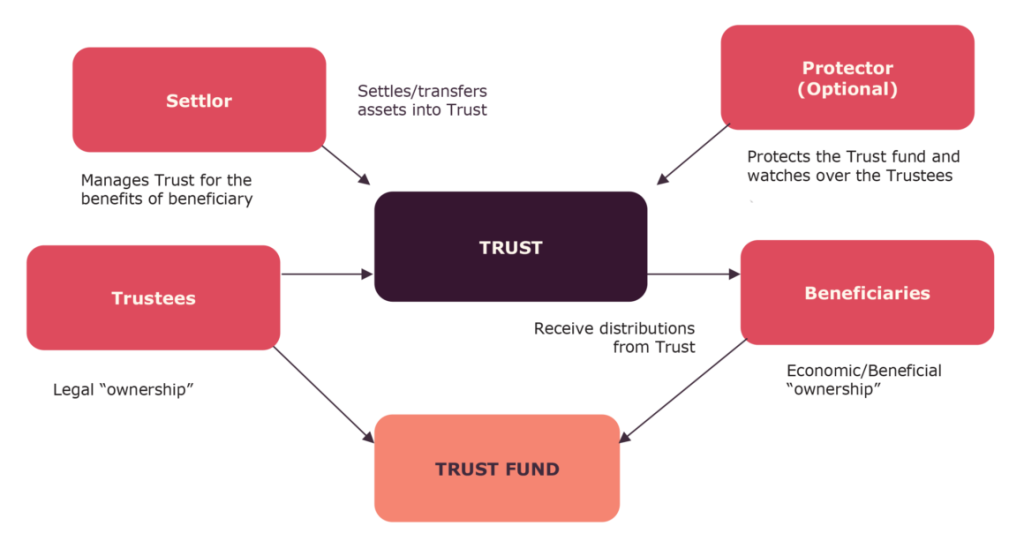

In general, a trust is a relationship in which one person holds title to property, subject to an obligation to keep or use the property for the benefit of another.1

A trust is formed under state law.2 In Texas, as elsewhere, trusts are rea11y simply a method by which one person (the trustee) holds property for the benefit of another person or group of persons (the beneficiary or beneficiaries). To establish a trust, someone (the settlor) must transfer title to identified property, with the specific intent to create a trust, to the trustee, who then manages and administers that property for the benefit of the beneficiary.3 In Texas, unless the instruments creating the trusts set out specific instructions, statutes will govern the trustee’s duties, rights, and liabilities toward the trust property and the beneficiary.

This chapter will discuss these issues as they relate to the elderly. In doing so, we shall discuss trusts wherein the elderly are either beneficiaries or settlors.

Creation and Validity of Texas Trusts

We have already noted that in Texas, in the absence of specific instructions set out in trust instruments, statutory law will govern the relationship between trustees and the trust they administer. The truth is, Texas has an entire body of law-the Texas Trust Code, which is itself embedded in the Texas Property Code-that governs the operation and administration of trusts in the state. The Code applies to (1) aU trusts created after January 1, 1984;1 and (2) all transactions after January 1, 1984, involving trusts even if the trust was created before January 1, 1984.5

- A Roadmap to Estate and Trust Income, NATP , presentation

- Recent developments in estate planning: Part 1

- Recent developments in estate planning: Part 2

- Recent developments in estate planning: Part 3

- AICPA Estate Planning Certificate Program

- The Adviser’s Guide to Financial and Estate Planning, Vol. , One, Two, Three, Four

- Videos Planning for the elderly and disabled,, Grantor retained interest trusts

- Form 1041, U.S. Income Tax Return for Estates and Trusts

- About Form 1041, U.S. Income Tax Return for Estates and Trusts

- Instructions for Form 1041, U.S. Income Tax Return for Estates and Trusts, and Schedules A, B, G, J, and K-1

9-2:1 Creation of Trusts

Several methods are available to a person who wants to create a trust. Two of the most common are the inter vivos or living trust and the testamentary trust.

9-2:1.1 Inter Vivos or Living Trusts

An inter vitJos or living trust is established while the settlor is alive with the intent that it will take effect while the settlor is still alive.6 l11e two basic methods a settlor may use to create an inter vivos trust are distinguished by the identity of the person who holds legal title to the trust property.

In the first method. a declaration (or self-declaration) of trust, the settlor declares himself or herself to be the trustee of certain property for the benefit of one or more beneficiaries. to whom he or she transfers equitable title.7111e settlor retains the legal title and is subject to self-imposed fiduciary duties.8

Under the second method, a transfer or conveyance in trust, the settlor transfers legal title to another person as trustee and imposes fiduciary duties on that person to manage the property for the benefit of either third parties or the settlor or both.9

9-2:1.2 Testamentary Trusts

We first encountered testamentary trusts in Chapter 8, as we discussed their inclusion in wills. \\Te discuss them again at this juncture to understand how they function as trusts.

Essentially, a settlor can establish a trust to take effect upon the settJor’s death by including a gift in trust in the settlor’s Last Will and Testament.10 l11e transfer of title to the trustee and the imposition of trustee duties on him or her do not occur until the settlor dies.

\Ve note that a pre-condition to the validity of a testamentary trust is that the Last Will and Testament of which it is a part must be valid. If the will fails, any testamen tary trust contained in that will is also ineffective. After the Last ·will and Testament is admitted to probate, the trust wi11 be examined to determine its validity. The fact that the Last Wi11 and Testament is valid does not grant automatic validity to the trust.

9-2:1.3 Intent to Create a Trust

A trust is established only if the settlor manifests the requisite intent to create a trust.11 A transferor of property has trust intent if he or she (1) divides title to the property into legal and equitable components and (2) imposes enforceable fiduciary duties on the holder of legal title to deal with the property for the benefit of the equitable holder.12

No particular words or conduct is necessary to establish trust intent. By the same token, the mere use of trust terminology alone is insufficient to show trust intent

Subtitle B Texas Trust Code: Creation, Operation, and Termination of Trusts Chapters

- Tex. Prop. Code § 111.004-Trusts Definitions

9-2:1.4 Consideration Not Required

Because a trust is a type of gratuitous property transfer, rather than a contractual arrangement, consideration is not required for the creation of a trust.13

9-2:1.5 Satisfying the Statute of Frauds

Generally, to be enforceable, a trust must be in writing.11 The writing must contain

(1) evidence of the terms of the trust (i.e., the identity of the beneficiaries, the proi:r erty, and how that property is to be used) and (2) the signature of the settlor or the settlor’s authorized agent.15

The above-mentioned requirements satisfy the Statute of Frauds. The policy under lying the requirement that trusts be evidenced by a writing is to protect a transferee who actually received an outright conveyance from having those rights infringed upon by someone claiming that the transfer was actually one in trust. Thus, an alleged trustee will use the lack of a writing to raise the Statute of Frauds as a defense to a plaintiff who is trying to deprive the alleged trustee of that person’s rights as the donee of an outright gift

The strict requirements of the Statute of Frauds are almost always enforced where the trust property consists of real property.16 That having been said, however, a court may enforce an oral trust of real property if the trustee partially performs. If the alleged trustee acts, at least temporarily, as if a trust exists, he or she may be estopped from denying the existence of a trust at a later time and claiming the property as th\ donee of an outright gift.

As regards trusts of personal property, two instances arise where the rules a: sometimes relaxed. First, an oral trust of personal property may be enforceable if thl trustee is neither the settlor nor a trust beneficiary and the settlor, either prior to or at the time of establishing the trust, expresses the intention to establish itY Second, a trust consisting o( personal property may be enforceable if it is in the form of a written declaration by the settlor who is also the owner of the property being transferred into trust and he or she now holds the property as trustee either for a third party or for himself or herself and a third party as beneficiaries.18

9-2:1.6 Trust Property

A trust is a method of holding title to property. Consequently, a trust cannot be cre ated unless it contains property. rn Any type of property-real, personal, tangible,

intangible. legal. and equitable. including property held in any digital or electronic medium ‘)-may be held in trust.21

Of course. in order to transfer property into a trust, the settlor must own the proir erty and must have the authority to transfer it. Accordingly, if a person cannot transfer the property-such as where the property belongs to another person, the property has valid restrictfons on its transfer, or the proposed trust res is an expectancy to inherit from someone who is still alive-he or she cannot transfer the property into a trust.:!! It is important. then, that before the elderly client directs his or her attorney to draft the trust instrument, he or she is certain that he or she (1) owns the proposed trust property and (2) has the authority to transfer it into trust.

TI1e trust creator must also ensure that legal title to the trust property reaches the hands of the trustee. It is not enough for the settlor to sign a trust instrument, own assets that would make good trust property, and intend for that property to be in the trust. TI1e settlor must go one step further and actually transfer or deliver the proir erty to the trustee.:?3

As a final matter, we note that if a settlor transfers property to a “qualifying trust” (basically a revocable living trust) that otherwise would qualify as the homestead of the settJor or the beneficiary had it not been transferred into the trust, this property may still qualify as the settlor’s or beneficiary’s homestead if the person occupies and uses it as his or her homestead.21 Accordingly, the homestead does not lose the creditor protection it would normally have merely because the homestead property is being held in trust.

9-2:1.7 Additions to Trust Property

Genera11y, property may be added to an existing trust from any source and in any manner. However, additions of property are not permitted if either (1) the terms of the trust prohibit the addition or (2) the property is unacceptable to the trustee (the trustee’s duties may not be enlarged without the trustee’s consent) .:i6

9-2:1.8 Capacity of the Settlor

When we studied wills. we saw how important the concept of capacity was to the validity of a Last Will and Testament. The concept is just as important in the realm of trusts.

Beginning with the settlor (for our purposes, the elderly person desirous of trans ferring property in trust), to create a trust, such settlor must have the capacity to convey property.27 This requirement does not impose upon the settlor any different standard than he or she would face in a non-trust situation involving the conveyance

of properly. Accordingly, the capacity required to create an inter vivos trust is typically the same as the capacity to make an outright gift and the capacity to create a·testamen tary trust is the same as the capacity to execute a Last Will and Testament.28

- TEXAS TRUST CODE

- Chapter 112 – CREATION, VALIDITY, MODIFICATION, AND TERMINATION OF TRUSTS (§§ 112.001 — 112.123)

- Chapter 113 – ADMINISTRATION (§§ 113.001 — 113.172)

9-2:1.9 Capacity of the Trustee

While it is important-particularly in the Elder Law context-to ensure that the settlor possesses the legal capacity to create a trust, it is also important that the trustee have the capacity to serve in this role. In short, the trustee must have the ability to take, hold, and transfer title to the trust property.29 What this means is that if the trustee is an individual, he or she must be of legal age (or have had the disabilities of legal age removed) and must be competent. lf the trustee is a corporate entity, it must have the power to act as a trustee in Texas.30 A trustee may also be the settlor or a beneficiary of the same trust so long as the sole trustee is not also the sole beneficiary.31

9-2:1.10 Acceptance by the Trustee

A person does not become trustee merely because the sett.lor names him or her as trustee of the trust. The settlor cannot force legal title and the accompanying fiduciary duties on an unwilling person. Hence, someone named as trustee must take some affirmative step to accept the position. Once the trustee has accepted the office, he or she is responsible for complying with the terms of the trust as well as applicable law.

The trustee may indicate his or her acceptance of the trust in two main ways. First, the trustee may sign the trust instrument or a separate acceptance document.32 \\’hen creating an inter vivos trust, it is common practice for attorneys to have the trustee sign the trust instrument at the same time as the settlor. TI1e signature of the trustee is conclusive evidence of acceptance.

Second, the trustee’s acceptance may be implied from his or her behavior-be havior of a nature whereby he or she has started to act like a trustee by exercising trust powers or performing trust duties.33 However. if the named trustee merely acts to preserve trust property after which he or she gives notice of his or her rejection of the office of trustee, or the person merely inspects or investigates the trust property, he or she will not be deemed to have accepted the office of trustee.34

If the named trustee does not accept, the office of trustee will pass to the alternate trustee named in the trust instrument.35 If the alternate trustee is dead or the trust instrument does not name one, an interested person may petition the probate court to appoint someone as trustee, whereupon the court will indeed appoint someone.36

9-2:2 Validity of Trusts

An elderly person who creates a trust must be concerned that the trust is valid. Several issues could affect a trust’s validity, including the legality of the trust’s pur pose. the reservation of interests and powers by the settlor, and whether the trust satisfies the doctrine oi merger and the rule against perpetuities. We shall discuss some of these issues.

9-2:2.1 Trust Purposes

As an initial matter, in Texas, the settlor may create a trust for any purpose as long as that purpose is not illegal.37 In short, the terms of the trust may not require the trustee to commit a criminal or tortious act or an act that is contrary lo public policy.38

Courts have used two main approaches in evaluating the legality of a trust purpose. The first analysis concentrntes on the settlor’s intent and the effect of the trust’s exis tence on the behavior of other persons. Under this intent approach, a trust is illegal if the existence of the trust could induce another person to commit a crime even if the trustee does not have to perform an illegal act.39 This is the majority approach in the United States, and the one adopted by Texas.·10 The second approach focuses on how the trust property is actually used, rather than on the motives of the settlor;·11

9-2:2.2 Active and Passive Trusts: Statute of Uses

The historical origin of the two components of trust intent, the split of title and the imposition of duties, is derived from the common law history of trusts. The common law precursor to a trust was called a “Use.” Hence, the old English statute governing trusts was called the Statute of Uses.·12 Under that statute, a beneficiary’s equitable interest in real property was turned into a legal interest as we1l. 1l1is had the effect of eliminating the legal interest the trustee formerly held. making the beneficiary the owner of all title, both legal and equitable. The beneficiary was also fully responsible for all of the burdens of property ownership.

The Statute of Uses was repealed by the Law of Property Act.·13 Even before the amendment took effect, several exceptions had developed to the Statute of Uses. Among these was the exception for the active trust, renected in today’s Texas Trusts Code.H

An active trust is an arrangement wherein the trustee’s holding of property is not merely nominal in an attempt to gain some untoward benefit, but where the trustee actually needs legal title to the property to perform a power or duty relating to the

beneficiary’s benefit.·15 In the absence of this arrangement, the purported trust is not valid, and title to the real property vests directly in the beneficiary. 16

Although the Texas Statute of Uses applies only to real property, a similar result would be reached for personal property because without a true split of title and impo sition of duties, the purported trust would fail to meet the definition of “express trust” required by the Texas Trusts CodeY

9-2:2.3 Reservation of Interests and Powers by the Settlor

An elderly person who retains the services of an attorney to draft a trust instrument on his or her behalf may well have two seemingly incompatible goals reference the gift he or she wishes to put in trust: the ability to make the gift and the ability to retain some control over the gift. May a settlor create a trust yet also retain considerable interests in, and powers over, the trust property?

Texas law takes a very liberal approach to this issue, providing that a settlor may retain virtua11y all interests over the trust property provided the trust creates some beneficial interest in another person.•1s Pursuant to the Texas Trusts Code, the settlor can retain the interests or powers without affecting the validity of the trust:

- a beneficial life interest for himself or herself;

- the power to revoke, modify, or terminate the trust in whole or in part:

- the power to designate the person to whom or on whose behalf the income or principal is to be paid or applied;

- the power to control the administration of the trust in whole or in part;

- the right to exercise a power or option over the trust property or over interests made payable to the trust under an employee benefit plan, life insurance pol icy, or otherwise; or

- the power to add property or to cause additional employee benefits, life insur ance, or other interests to be made payable to the trust at any time. 9

In light of a11 the powers that can be retained by the settler, the beneficial interest created in the other person could be quite weak. Indeed, it could be contingent upon some future event or be subject to revocation by the settlor!50

9-2:2.4 Doctrine of Merger

As the elderly person begins to consider establishing a trust, he or she must be careful to ensure that he or she does not, as settlor, transfer both the legal title and all equita ble interests in property to the same person; if this happens, a trust will not have been

created, and the transferee would hold the property as his or her own.51 1l1e same result will pertain if the settlor retains both the legal title and all equitable interests in the trust property in himself or herself as the sole trustee and the sole beneficiary.52

If. after the initial creatfon of the trust, legal and equitable interest becomes reunited in one person (such as if the same person becomes the sole trustee and sole beneficiary). merger occurs and the trust will cease to exist.33 Of course, this is just what happens when the trust terminates and the trustee distributes the trust property to the remainder beneficiaries. However, merger could occur earlier either because of circumstances the settlor did not anticipate or because the trustee and the beneficiary are working together to terminate the trust. Because a trustee could work together to circumvent the settlor’s intent and cause the trust to terminate, Texas law holds that a trust containing a spendthrift provision5-‘ will not end via merger unless the settlor is also the beneficiary. Instead, the court will appoint a trustee to keep the title split.56

9-3 Types of Trusts of .Interest to the. Elderly

As the elderly look back on their lives and look forward to their “sunset years,” they may be interested in four types of trusts, in particular: (1) the revocable living trust.

(2) charitable trusts, (3) a trust for the care of animals (also known as the pet trust), and (4) a spendthrift trust. We dedicate the rest of this chapter to discussing these four types of trusts.

9-3:1 The Revocable Living Trust

As compared to the ”regular” trusts we have been discussing thus far, a Texas living trust is created during the settlor’s lifetime but the provisions can be altered or can celed–or the trust can even be terminated-by the sertlor (referred to in this context as the “grantor..). During the life of the trust, income earned is distributed and taxed to the grantor.5’7 and it is only after the death of the grant or that property is transferred to the other beneficiaries.

Essentia11y, the grant.or creates the living trust to help himself or herself during his or her lifetime. and then to help other beneficiaries after he or she dies. The trust also helps the grantor solve certain est.ate and probate problems. Finally, it may help the grantor achieve other commendable goals while he or she is alive and able to enjoy the trust benefits. However, because of the doctrine of merger,;,8 the grantor cannot be the sole beneficiary of the trust.59 For this reason, the trust has other beneficiaries besides the grantor. Not only that, but the trust agreement must also be carefully worded so that the trust purpose reflects a purpose beyond providing solely for the grantor.

All things considered, a Texas living trust is also a contract to manage the grantor’s assets and protect the grantor if he or she becomes disabled. The living trust can be either revocable or irrevocable. As an estate planning tool, however, the revocable living trust has become very popular. The remainder of our discussion of the living trust will focus on this type of will substitute-the revocable living trust. We note from the onset that because the living trust is both revocable and amendable, the grantor can change it when he or she needs to.

9-3:1.1 Parties to the Revocable Living Trust

A revocable living trust has four important parties and one group of parties. These a11 interact in the best interests of the grantor. First, we have the grantor. the trustee, and the primary beneficiary. These are rea1ly the same person. Next comes the successor trustee. Third comes the remainder beneficiaries. \Ve shall discuss the role of each of these in turn.

9-3:1. la The Grantor

The grantor establishes the trust, provides assets to the trust, and determines the trust’s goals.00The grantor has the power to revoke or amend a living trust-unless he or she gives up that right when the trust is first created.61 We note that this language is somewhat unique to Texas because unlike what prevails in most states, all trusts are presumed revocable in Texas.62

9-3:1.1 b The Trustee

The trustee manages the trust and its assets on a daily basis.63 In a revocable living trust, the grantor is also the trustee. He or she serves as the legal owner and manager of a11 the trust assets.

9-3:1.1c The Successor or Contingent Trustee

Upon the death of the grantor, the trust becomes irrevocable. That the trust may con tinue to function, the trust, at fl1e time of its creation, names a successor or contingent trustee. Upon the death of the grantor (and original trustee), this successor trustee now succeeds to the office of trustee and administers the trust pursuant to its terms.c.>1

The successor or contingent trustee also succeeds to the trusteeship in the event the grantor-trustee suffers a disability and is no longer able to function as trustee of the revocable living trust.65

9-3:1.ld The Primary Beneficiary

ll1e primary beneficiary receives the income and other present interests of the trust. Typically, the grantor is the primary beneficiary. He or she receives trust income du1ing life. along with other lifetime benefits from the trust. Moreover, the grantor, as primary beneficiary. has access to the trust corpus and to the use of the trust’s other assets such a:s his or her home, car, and other personal property.66

9-3:1.1e The Remainder Beneficiaries

A second set of beneficiaries, the remainder beneficiaries, receive no benefits from the trust until the grantor-trustee-primary beneficiary dies. They must be patient and wait to receive their trust benefits.

Upon the death of the grantor-trustee-primary beneficiary, the successor trustee begins to administer the trust pursuant to the terms laid out in the trust instrument. In most instances, this merely entails distributing the trust assets to the designated remainder beneficiaries.

9-3:1.2 Funding the Living Trust

Long before the successor u·ustee gets to distribute trust assets, however, the grantor needs to fund the trust. Funding the trust entails transferring ownership of assets from the grantor to the living trust.67 The grantor must physically change the titles of assets owned from his or her name (or joint names, if married) to the trustee of the living trust. The grantor must also change the beneficiaries’ designations on life insur ance, retirement assets, and other types of assets to the trustee. Of course, because the grantor is also the trustee, the change in ownership will not have any adverse effect on the grantor.

It is very important that the grantor funds the revocable living trust. Failure to do so will mean that upon the grantor’s death, nothing will be in the trust and the entire estate will have to go through probate. IJ probate minimization was one of the grant or’s goals in creating the living trust, his or her failure to fund the trust would have defeated that goal. The time, effort, and money he and she expended on establishing the trust could have been spent doing something else.

9-3:1.3 The Pour-Over Will

To accompany a revocable living trust, the grantor must execute a pour-over will. This will causes any forgotten or recently acquired assets to be transferred into the living trust at the grantor’s death. While this does not necessarily avoid probate, it at least ensures the assets will pass under the revocable living trust and in accordance with the grantor’s wishes.

9-3:1.4 Functions of the Revocable Living Trust

The revocable living trust serves a variety of purposes for the elderly individual. As an initial matter, the individual needs to carefully examine his or her life circumstances to determine whether it would be to his or her advantage to create a revocable living trust. It would be a mistake for an elderly person to create a revocable living trust simply because “all” of his or her friends have one. After all, what works for the friends may not work for this particular elderly person. vYhat each elderly person must do is study the general functions of revocable living trusts and determine which of these are applicable to his or her life situation. Following are some of the important func tions of revocable living trusts.

9-3:l.4a Minimizing Probate

Many estate planners and financial consultants tout the revocable living trust as a tool for avoiding probate. That may not necessarily be true; it. would be better to view the revocable living trust as a tool to minimize probate. lf in the process one is able to avoid probate, all the better.

After the individual has created the revocable living trust, he or she funds it by transferring all of his or her assets into it. These assets are not part of the probate estate upon the grantor’s death. ‘n1e property remaining in the trust. when the grantor dies is administered and distributed according to the terms of the trust; it does not pass under the grantor’s Last \Viii and Testament or by intestate succession. However, any assets that are somehow not transferred into the trust are not subject to trust administration. Should the grantor die at a time that these assets are still not part of the trust, they shall be subject to probate. The same is true of any assets the grantor acquired after he or she created the trust but fajled to transfer into the trust.

Generally, advantages to avoiding or minimizing probate include getting the prop erty into the hands of the beneficiaries quickly, avoiding gaps in management, and avoiding publicity. However, probate in Texas is often simpler and less expensive than its general reputation would lead someone to believe. Tirnt being the case, the elderly person should think carefully about the choice he or she should make: the Last \Vill and Testament or the revocable living trust. The at1orney consulted about the matter should be honest and counsel the client about his or her possible choices in light of the assets the client owns and the goals he or she wishes to achieve through his or her estate plan.

9-3:1.4b Avoiding Probate of the Homestead

\Vhile the revocable living trust can be used as a tool to minimize or avoid probate in almost. all cases, it is a definite method available for avoiding probate of the home stead. A living trust of this type is distinguishable from other kinds of land trusts such as a pure anonymity/ asset protection trust that has no probate objectives, or an inves tor trust that contemplates short-term acquisition of investment property or a transfer of underlying ownership by means of an assignment of beneficial interest.

A middle class elderly individual living in Texas should give serious consider ation to creating a revocable living trust-to use with the accompanying pour-over will-as a means of probate avoidance of the homestead. We note that because Texas

homesteads are already protected from forced sales to satisfy judgments,68 the empha sis is on probate avoidance, not asset protection.

9-3:1.4b1 Creating the Trust

l11is type of trust can be created through a three-part process: (1) establishing the trust with a signed trust agreement, (2) executing and filing a warranty deed convey ing the home into the trust, and (3) executing a pour-over will to move miscellaneous assets into the trust upon the grantor’s death.69

As with other trusts, a grnntor creates the trust and transfers property into it.70 A trustee (or co-trustees if the trust is being created by a married couple) is appointed to direct trust affairs on behalf of the beneficiaries (again, usually the spouses) and, upon the death of the last beneficiary, on behalf of one or more contingent beneficia ries (usually the couple’s children). Since title remains in the trust, and the trust does not die, the surviving beneficiaries “inherit” the trust property but without probate or other involvement by courts or lawyers. All that changes are the percentage beneficial interests in the trust, and this occurs automatically.

9-3:l.4b2 Preserving the Homestead Tax Exemption

Real property is conveyed into trust by general or special warranty deed recorded in the County Clerk’s real property records. The deed should make certain specific recitals concerning the homestead nature of the property. Conveying the proper·ty by deed into the living trust is an essential part of the process since the trust agreement, by itself, does not transfer title.

To preserve the homestead tax exemption, the trust agreement should contain language that preserves (1) homestead protections available to the grantor pursu ant to the Texas Constitution,71 and the Texas Property Code;72 and (2) any available homestead tax exemption, whether currently on file or not. It is prudent to make these express recitals in the trust agreement even though Texas Property Code Sec tion 41.0021 states that transfer of a residence into a “qualifying trust” (i.e.. a revoca ble living trust) retafos the homestead character of the property.n Similar language should also be recited in the deed transferred into trust so as to make it clear to the local taxing authorities that a living trust has been established for the homestead.

9-3:l.4c Protecting the Grantor and His or Her Assets

When an elderly person establishes a revocable living trust, he or she is cypica11y both the beneficiary and the trustee. As time passes by, though, the grantor may want someone else to be trustee. By then, he or she may be disabled, maybe his or her spouse has died, maybe he or she has made plans to travel in his or her “old age,” or

maybe he or she is just tired. ‘Whatever the reason, the grantor-trustee wants to take a break.

Because the grantor-trustee would have chosen someone he or she trusts as the successor or contingent trustee, he or she can call on that person to take over the management of the trust. Management of the grantor’s assets would then continue uninterrupted. Investments would continue without interruption: payments would be made on time: expenses would be managed; medical bills would be paid: the grant or’s health care would be provided for continuously. Everything concerning the trust would continue as if the grantor were still in charge.

Accordingly, the revocable living trust would continue to protect the grantor and his or her assets.

9-3:1.4d Providing for the Grantor’s Beneficiaries

A revocable living trust can be written so that part of it mimics a Last ·will and Testa ment. It caJ1 contain instructions for the distribution of the grantor’s assets after he or she dies. In this way, it can provide benefits to the grantor’s heirs. Not only that, but the grantor can also choose to provide benefits to someone while the grantor is still alive! Indeed, with a revocable living trust, the grantor has much flexibility and can direct his or her giving so that his or her funds will go to be used by the beneficiaries he or she most cares about and the causes that for him or her matter most.

9-3:1.5 Negative Aspects of the Revocable Living Trust

Notwithstanding the beneficial aspects of the revocable living trust, an elderly person considering executing one must also consider the negative aspects. The following sections present four such negative aspects.

9-3:1.Sa Cost

A ful1y-funded revocable living trust requires the grantor to transfer ownership of his or her assets out of his or her name into that of the trust. The attorney must draw up new deeds for property being transferred into the trust; new title must be acquired for these properties. Ownership of trust assets must be registered with the trust itself. All of this costs money. Accordingly, the elderly person desiring to create a revocable living trust must ensure that he or she has the funds to expend on the project. Having just enough money to pay the attorney to draft the trust instrument will do little good; if this is the case, the potential grantor wi11 eventually die and his or her heirs will dis cover that lhe trust was not effective and the decedent’s estate is subject to probate, after all.

9-3:1.Sb Constant Attention

As trustee of his or her revocable living trust, the elderly person must deal with the trust regularly throughout the rest of his or her life. ‘Whenever he or she wants money, he or she must deal with the trust. \\Thenever he or she wants to acquire or sell an asset, he or she must deal with the trust·.whenever he or she receives income, he or she must deal with the trust. Wl1ile these duties are not too different from going about managing life without a trust-that is, doing things like balancing a check book,

paying bills, and making investment decisions-for an elderly person who is not sawy about these matters or who is not as “sharp” as he or she was in previous years, fulfill ing these duties could be problematical.

9-3:1.Sc Probate Still Possible

One of the best reasons for establishing a revocable living trust is to minimize-if not eliminate-probate. However, the trust will succeed in doing that only if it owns all of the grantor’s assets when he or she dies. If so much as a single stock certificate, single bank account, or single parcel of real estate remains out of the trust at the time of the grantor’s death, this portion of the estate will have to go through the probate process. It is important, therefore, that the trust instrument be well drafted, the trust be well funded, and that the pour-over will be well written so that upon the grantor’s death, any of his or her assets that are not in the trust will be transferred therein by the pour over will, thereby minimizing-or even avoidling-probate.

9-3:1.5d No Transfer Tax Savings

The revocable living trust is not designed to save on federal transfer taxes-that is, the estate, gift, and generation transfer skipping taJCes. People with large estates desir ing to save on transfer taJCes should look to other trust instruments and estate plan ning techniques for relief. The truth is, a revocable living trust will not give a taxpayer any greater tax savings than he or she is already entilled to receive.

9-3:1.6 Revoking a Revocable Living Trust

Most revocable living trusts meet their end automatically, as scheduled by the trust’s creators in the trust instrument, sometime after the grantor or granters have died.74 Even after the event of termination (such as the grantor’s death) has occurred or the period of time for the trust’s existence (such as until the grantor’s children reach the age of majority) has elapsed, the successor trustee may continue to exercise the pow ers of trustee for a reasonable period of time required to wind up the affairs of the trust and to distribute the assets to the appropriate benefkiaries.75 1l1e fact that the successor trustee continues to exercise trustee’s powers at this point does not in any way affect the vested rights of the beneficiaries of the trust.76

That being said, it is possible that the grantor-trustee-beneficiary may want to revoke the trust prior to his or her death. Texas law provides that a grantor may revoke a trust unless the trust is irrevocable by the express terms of the instrument creating it or of an instrument modifying it.77 However, this power to revoke carries one caveat: If the trust was created by a written instrument, the revocation must also be in writing.78

If a granter is authorized to revoke the trust, after executing the document effect ing the revocation, the individual must “un-fund” the trust-take the trust’s name off

his or her assets, or re-transfer the assets from the trust to himself or herself. This may be a lengthy process, but it must be done.

9-3:2 Charitable Trusts

As people age, they think increasingly about the blessings they have received in life and about the charitable organizations that have helped them along life’s jour ney. Among these organizations are churches, mosques, synagogues, health organ izations, educational institutions, civic organizations, and fraternal beneficiary socie ties. Unless these organizations are denied tax exemption under Internal Revenue Code Section 502 or 503, the Internal Revenue Code exempts them from income tax ation.79 Subject to certain annual percentage limitations, the Code allows taxpayers to deduct the value of contributions made to these organizations from their adjusted gross income for purposes of determining their federal income taxes due each year.80 The Code also allows taxpayers to make inter vivos transfers to these organizations without any gift tax consequences,81 and testamentary transfers without any estate tax consequences.82 Because Texas does not impose gift, estate, or inheritance taxes on gratuitous transfers, Texas law does not apply to these exemptions.

Keeping the federal exemptions in mind, then, an elderly person has various meth ods available for making gifts to charitable organizations. TI1e person could make:

- gifts of cash (which makes valuation quite easy);

- gifts of personal property;

- gifts of real property;

- gifts of life insurance; and

- gifts in trust.

The person would have various options for making charitable gifts in trust Follow ing is a discussion of these.

9-3:2.1 The Pooled Income Fund

A pooled income fund is a charitable trust established and maintained by a qualified non-profit organization (commonly called a Section 501(c)(3) organization).53 ·when an individual donates funds to the charitable organization, he or she effectively trans fers an irrevocable remainder interest to the charity, and retains an income stream for life.81 The organization then pools all donations received from various donors and invests them, providing each donor and his or her beneficiaries with a lifetime income stream based on a prorated share of the income earned by the fund.85 The Code does not provide for any exemption from income tax for this income.

However. the donor receives certain tax benefits for making this charitable contri bution. As an initial matter. in the year the donor makes the contribution to the fund, he or she receives an income tax deduction for the value of the remainder interest of the gift (calculated using figures provided by the Internal Revenue Service [IRS]). ; Upon the donor’s death. the fund keeps the principal (or remainder interest). By then, though. the donor might have earned the entire value of this interest back as invest ment income, without any of it showing up in his or her estate at death, where it would have been subjected to the higher estate tax rates.

9-3:2.2 Charitable Remainder Trust

For the individual who wants to create his or her own charitable trust, and who wants to make a substantial gift to charity, the charitable remainder trust might be a better option.

9-3:2.2a Definition

Generally, a charitable remainder trust (CRT) is a trust that provides for a specified distribution of income, at least annually, to one or more beneficiaries-at. least one of

,, hich is not a charitable organization-for life or for a term of years, with an irrevoca ble remainder interest being held for the benefit of, or to be paid over to, one or more charitable organizations.87 For the sake of simplicity, we shall address this issue here as if the remainder interest goes to only one charitable organization.

It is important to note that the trust is irrevocable. Once the trust has been estab lished. the grantor cannot change his or her mind. l11ere is no turning back.

9-3:2.2b Establishing the Charitable Ren-iainder Trust

An individual wishing to establish a CRT must first establish an irrevocable trust and transfer into it the property he or she wishes to donate to the charitable organization. To maximize his or her benefit from the transaction, the grantor should transfer an appreciated asset-such as stock or highly appreciated real estate-into the trust. Of course. the grantor must ensure that the charitable organization is one recognized as such by the IRS. Generally, this means that the organization must be exempt from paying taxes.68

By establishing the trust in this manner, the grantor removes the asset from his or her estate, thereby ensuring that the estate will not be liable for estate taxes on account of the asset upon his or her death. Meanwhile, after the charitable trust receives the asset, the trustee will sell it at full market value, will pay no capital gains tax on the proceeds,ro and will then re-invest the proceeds in income-producing assets. The trustee will then pay this income to the grantor and/or any other beneficiaries named in the trust instrument (making such payments at least annually), with such

payments continuing either for a term of years not to exceed 20 years or for the life of the grantor.90

The grantor must give careful consideration to the question who should serve as trustee of the CRT. Choices include the grantor, the charity, a corporate trustee. or someone else. The trustee is charged with the duty of investing, protecting, and man aging the trust assets. As we have already stated, each year the trustee will pay the grantor or the named income beneficiary or beneficiaries a portion of the income that the trust fund accumulates. These payments will last for a set number of years (not to exceed 20), or for the remainder of the grantor’s life.91 The trust will end at the time of the grantor’s death. at which time the corpus (i.e., the remainder interest) will vest in the charitable organization.92

9-3:2.2c Tax Advantages of the Charitable Remainder Trust

In addition to allowing the grantor to donate to a charitable organization of his or her choice, a CRT provides him or her with three distinct tax benefits.

First, after the grantor has established the CRT and donated property to the charita ble organization. he or she has the option to take an income tax deduction on account of the remainder portion of the donation, which is the true .gift to the charitable organ ization.93 However, the grantor does not receive a dollar-for-dollar deduction; instead, the IRS calculates the total income tax deduction based on the valuation tables of Internal Revenue Code Section 7520.91

Second, because the property the grantor transferred to the trust will go to a char itable organization upon his or her death, its value will not be included in his or her estate for purposes of determining the federal estate tax due, if any.9

Third, and last. a charitable trust allows a grantor to turn property that is not pro ducing income into cash without paying taxes on any profits gained. For example, if Darby held 5,000 shares of stock that had appreciated in value from $10 a share to $75 a share in the years that she held it, she could sell the stock and pay capital gains tax on the $65 gain per share. However, if Darby donates the stock to a charitable trust, the trust can sell the stock and not pay any tax on the sale. Not only that, but Darby’s charity can also sell the $375,000 worth of stock, invest the money in a mutual fund, and pay Darby the interest from this fund for the rest of her life, all without capital gains tax. If Darby had chosen to sell the $375,000 worth of shares herself, she would have had to pay capital gains tax on the proceeds.

9-3:2.2d Types of Income From the Charitable Remainder Trust

When the individual establishes the CRT, he or she will have a choice between two different ways of receiving income from the fund. TI1e choices result in the existence

of two types of CRTs-the Charitable Annuity Remainder Trust (CRAn and the Char itable Remainder Unitrust (CRUl).

9-3:2.2d1 Charitable Re1nainder Annuity Trust

A granter can opt to receive income in the form of a fixed annuity. Under this option. he or she will receive a fixed dollar amount from the trust each year. 111e granter can choose to receive these payments for a term of years not to exceed 20 years, or for the rest of his or her life.96 Regardless whether the trust has a bad year and ends up losing money, the granter will still receive the fixed dollar amount from the trust each year.

9-3:2.2d2 Charitable Re1nainder Unitrust

Another option for income payments is for the granter to set up his or her annual pay ment as a percentage of the current value of the trust. No matter how much the trust made or lost in a particular year, the grantor (or a named beneficiary or beneficiaries) will receive the same percentage share each year. The percentage must be at least 5% of the trust’s value, but no more than 50% thereof.97

9-3:2.3 The Charitable Lead Trust

In many ways, the Charitable Lead Trust (CLl) is the exact opposite of the CRT. Yet, though the mechanisms may be different, the goals are somewhat similar.

9-3:2.3a Definition

In a CLT, a grantor makes a gift to a charitable organization. The charity keeps the income instead of paying it to the grantor or his or her beneficiaries.98 However. when the trust ends, the original gift amount is returned to the grantor or his or her heirs.

The grantor benefits by getting an income tax deduction each year the trust is in effect.99

‘vVe have aJready noted that the mechanisms of the CRT and the CLT are different. Indeed, the rules governing the two are so different that whereas there are two types of CRTs, there are four types of CLTs:

- Qualified Reversionary Grantor Trust;

- Qualified Nonreversionary Granter Trust;

- Qualified Nonreversionary Nongrantor Trust; and

- Qualified Reversionary Nongrantor Trust.

Each type of trust produces different tax benefits that can be matched with the donor’s personal and philanthropic planning objectives.

9-3:2.3al Qualified Reversionary Grantor Charitable Lead Trust

Qualified reversionary grantor CLTs are created during the life of the donor for the purpose of paying an income interest to charity for a term defined in the trust instru ment, after which the remainder interest reverts to the grantor.

Granto rs creating grantor CLTs receive a charitable contribution income tax deduc tion in the year the trust is created for an amount equal to the net present value of the income interest passing to charity. To qualify for income tax deduction purposes, the granter must be treated as the owner of the trust’s income under the grantor trust rules of 26 U.S.C. §§ 671-678. Accordingly, all income produced by the trust during the trust term, including amounts distributed to charity, is taxable to the granter. On conclusion of the measuring term. the trust assets revert to the granter or to the grantor’s estate.

Qualified reversionary grantor CLTs are particularly useful for donors who desire to make a multi-year charitable pledge and accelerate the charitable deductions-that would otherwise be produced over the pledge period-into the first year.

9-3:2.3a2 Qualified Nonreversionary Grantor Charitable Lead Trust

The qualified nonreversionary granter CLT is a more recently approved variation of the CLT that produces both income and gift tax deductions. Simply stated, it is similar to a nongrantor nonreversionary lead trust in that it qualifies for a charitable gift tax deduction; however, it contains an intentional drafting defect (i.e., a right held by the granter or non-adverse party to the grantor to re-acquire trust property by substitut ing other property of equivalent value) that causes the granter to be considered as the owner of the trust’s income. TI1is latter component also qualifies the transfer for charitable income tax deduction purposes.

Provided the granter does not retain any rights that would otherwise cause the gift to be considered incomplete for gift tax purposes, the taxable transfer to the heirs becomes cmnplete when the trust is established. Further, assuming the granter retains no estate tax interests or strings, no portion of the trust is includible in the grantor’s estate.

9-3:2.3a3 Qualified Nonreversionary Nongrantor Charitable Lead Trust

Qualified nonreversionary nongrantor CLTs are created for the purpose of paying an income interest to charity for a defined measuring term with the remainder interest transferred to one or more non-charitable beneficiaries named in the trust instrument.

l11e grantor’s children and grandchildren are the most frequently named beneficia ries of these types of trusts.

As its name suggests, a non-grantor trust does not qualify under grantor trust rules: accordingly. the grantor does not receive a charitable income lax deduction. However. none of the income produced by the trust is taxable to the grantor. A quali fied nongrantor CLT is taxed as a complex trust.

If the non-grantor trust is created on an inter vivos basis, the grantor receives a gift tax charitable deduction in an amount equal to the net present value of annuity or uni trust income interest payable to charity. If the trust is created on a testamentary basis. the grantor’s estate receives an estate tax charitable deduction, also based on the net present value of the income interest. Depending on the combination of the measuring term and income amount payable to the charity, it is possible to produce a charitable gift or estate tax deduction that equals the amount transferred, thereby creating a gift and estate tax-free transfer.

A grantor can also utilize a Nonreversionary Nongrantor CLT to leverage the generation-skipping transfer tax exemption for transfers to grandchildren and other skip persons. The benefits of wealth transfer can be amplified by funding the trust with assets that qualify for valuation discounts such as units in family limited partner ships and other types of minority fractional interests in property.

9-3:2.3a4 Nonqualified Nongrantor Reversionary Charitable Lead Trust

In order to qualify for income, gift, and estate tax deduction purposes, a CLT must pay a guaranteed annuity or unitrust amount. Nonqualified CLTs are designed to violate this rule and, therefore, produce no income, gift, or estate tax deductions. Gift and estate tax deductions are immaterial because the trust will revert to the grantor. The trust will. however, be able to claim gift tax deductions for income amounts trans ferred to charity as they occur.

\\’hat is important to th.ese types of trusts is the fact that although no income tax deduction is available, neither is any of the trust’s income taxable to the gr an tor. These trusts are taxable as complex trusts for which they can claim a deduction against their taxable income for amounts distributed to charity.

9-3:2.4 Texas law on Charitable Trusts

ln Texas, the attorney general has standing to enforce charitable trusts.1c;’ To increase the likelihood that the attorney general is aware of lawsuits involving charitable trusts, Texas law requires that the party initiating the action give notice to the attorney gen eral.101 This notice must be given by certified or registered mail within 30 days of fiJing, but not less Lhan 25 days before a hearing, and must include a copy of the peti tion.102 The Texas Property Code provides an extensive Jist of proceedings to which the attorney general is entitled to notice.103

If the attorney general does not receive notice, any judgment or settlement is voidable-that is, the attorney general may set aside any judgment or settlement at any time. TI1e attorney general needs no grounds other than that he or she did not receive notice.101

Texas gives a broad definition to the term “charitable trust.” In addition to tradi tional charitable trusts, the term encompasses any inter vivos or testamentary gift to a charitable entity.105 ‘n1e term “charitable trust” also includes any charitable entity, even if it is not run as a trust.106

…

chapter pdf

- Federal Deposit Insurance Corporation. “Revocable and Irrevocable Trust Accounts.”, “Revocable Trust Accounts (12 C.F.R. § 330.10)“, “Irrevocable Trust Accounts (12 C.F.R. § 330.13)“, Department of Justice. “Handbook For Chapter 7 Trustees Forms and Instructions.” ↩︎